1. When will we feel safe?

“Feel the city breakin' and everybody shakin' I'm a-stayin' alive, stayin' alive”

'Stayin’ Alive' by the Bee Gees (1974)

Vaccines are being administered but distribution is proving to be more problematic than many hoped for. There are likely to be more than a few bumps along the vaccination road, but consensus is that by the end of Q3 the West and much of Asia will have reached effective immunity status. There are few projections for the developing nations, many of whom are unlikely to reach optimal vaccination strategies in 2021.

While the end of Q3 is some way away, each day will drive us closer to an effective level of immunity. Social distancing and intermittent lock downs will continue through Q1 but will become an unwanted part of history as we approach the middle of the year. This should mean a relative return to business as a new normal.

2. Asset prices have experienced unprecented volatility in 2020 and have closed the year strongly, is this likely to continue?

“I thought that we had made it to the top I gave you all I had to give Why did it have to stop? You've blown it all sky high”

'Sky High' by Jigsaw (1974)

The response across the globe from Governments to the pandemic was unprecedented and has led to a rally in asset prices (here shown as the S+P 500) despite the steady increase in Covid infections.

S+P 500 (purple) and daily New US Covid cases ( gold)

Source Refinitiv

I cannot find an asset class where predictions for 2021 are not for a 10% increase in prices (well, maybe in Crypto). That does not mean the consensus will be wrong. We can assume that 2021 will be less volatile assuming the vaccines remain effective and that interest rates do not rise. Its is highly probable that both will in fact bear out. Rates are by far the most important variable and for now Central Banks will fight to keep them low, a policy that will eventually change with a bang but this seems unlikely in 2021, certainly in the first half of the year.

This will cause a continual search for yield and an increase in riskier investments.

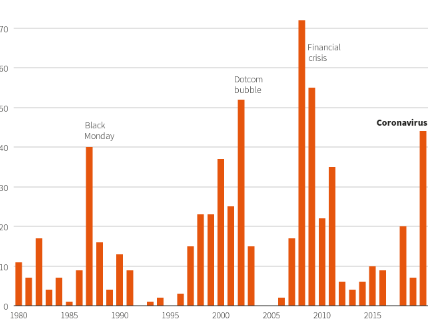

The volatility of all asset prices is mirrored in the S+P 500. The chart represents the number of days with a more than 2% swing in the S+P 500. The chart clearly demonstrates how volatility falls in the following years after such an event but what the chart doesn’t show is that equity prices started in the following periods at or near the crisis induced lows. Note that 2021 begins with prices at record highs.

Source Refinitiv

3. What trends of 2020 will persist?

“All day Staring at the ceiling makin' Friends with shadows on my wall”

'Unwell' by Matchbox Twenty (2009)

We know that the pandemic forced the acceleration of many trends, notably the increased use of technology, where 10 years’ worth of growth happened in a matter of months. These trends seem irreversible (other than minor corrections) but their impact may well be more nuanced than simply increasing technology company revenues.

Remote working became ‘Work from Home’ (WFH), and remote learning became ‘Learn and Teach from Home’. WFH will remain a part of normal work life, although it is more likely to be 1-2 days a week for most. Even so, this will change the demand for office space, lessen commuting times and reverse the multi decade trend towards urbanisation. It will also change the way dwellings are constructed as WFH space will become an essential part of residences.

The trend towards digitisation will continue but the peak of demand for WFH hardware may have passed, the upgrade/ new technology purchase in many cases has already occurred. The industries hit hardest by Covid will recover but will have to do so with reduced demand as so much has moved online. Not all the trends that emerge will be positive, notably a likely continued increase in mental health issues.

4. One of the most unusual consequences of the pandemic and the fiscal response has been the surge in personal saving’s rates in many parts of the world. This should help fuel spending into 2021 in developed markets, but many will remain wary that assistance packages have or are soon to peak.

“I don't know what they want from me It's like the more money we come across The more problems we see”

'Mo' Money Mo' Problems' by The Notorious B.I.G (1997)

Savings as a percent of disposable income

Source Refinitiv

Loan and rental deferrals were part of the fiscal response, as were changes in banks reporting requirements and adjustments to bankruptcy laws.

Australian Company Bankruptcies 2012-2020

Source Trading Economics, ASIC

Australian Personal Bankruptcies in the 2019-20 financial year fell to their lowest level since 1989-90. These trends were also seen in other major economies as Government support measures helped keep business and individuals afloat. But this is changing, notably in Australia and is likely to make H1 2021 more volatile than most expect.

Sadly, this withdrawal of fiscal support is likely to lead to increases in mental health issues.

5. Are there geopolitical ramifications of the pandemic?

“War, huh Yeah! What is it good for? Absolutely nothing. Say it again”

'War (What is it good for)' by Edwin Starr (written by Norman Whitfield and Barrett Strong) 1970

Wuhan went into lockdown in January 2020. A year later and many places will be back in lockdown. What did or didn’t we learn? The ramifications of the virus will become apparent when the war to defeat the virus is won.

Some possible issues are: a. A permanent change to global supply chain economics

b. A permanent increase in medical expenditure

c. A permanent downshift in the trend of globalisation

d. Increased risk of future military conflict, particularly with regards China

e. A refocus on climate change

f. A carbon induced change in the way everything is priced (the cost of everything should include its environmental impact)

g. An ever-increasing demand for sustainable assets

h. A peak in global debt

i. Inflation

j. A trend away from privacy (via tracking apps) before an aggressive swing back as Covid is eradicated

k. Travel to return, but not before late 2021

This is by no means an exhaustive list and each has investment and life ramifications. While its easy to smile and say good riddance to 2020 the reality is that the impact of 2020 will define the decade ahead.

Beckon Capital Pty Limited (ABN 49 628 013 678), authorised representative No. 001280538 of Fundhost Limited (ABN 69 092 517 087, AFSL No. 233045) (“Beckon”)